[fusion_builder_container hundred_percent=”no” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_separator style_type=”none” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” sep_color=”” top_margin=”20px” bottom_margin=”20px” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”center” /][fusion_title margin_top=”” margin_bottom=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” size=”2″ content_align=”center” style_type=”default” sep_color=””]

Co Guarantor Vs Cosignor | Which Option Should I Pursue?

[/fusion_title][/fusion_builder_column][fusion_builder_column type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_youtube id=”Lomux8VaBFo” alignment=”center” width=”” height=”” autoplay=”false” api_params=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” /][fusion_imageframe image_id=”2757″ style_type=”none” stylecolor=”” hover_type=”none” bordersize=”” bordercolor=”” borderradius=”” align=”none” lightbox=”no” gallery_id=”” lightbox_image=”” alt=”Co Guarantor Vs CoSignor” link=”” linktarget=”_self” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]https://kylewilson.ca/wp-content/uploads/2018/04/CO-Guarantor-VS-CO-Applicant-1024×576.jpg[/fusion_imageframe][fusion_youtube id=”6AvrjOxJAwo” alignment=”center” width=”” height=”” autoplay=”false” api_params=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” /][/fusion_builder_column][fusion_builder_column type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text]

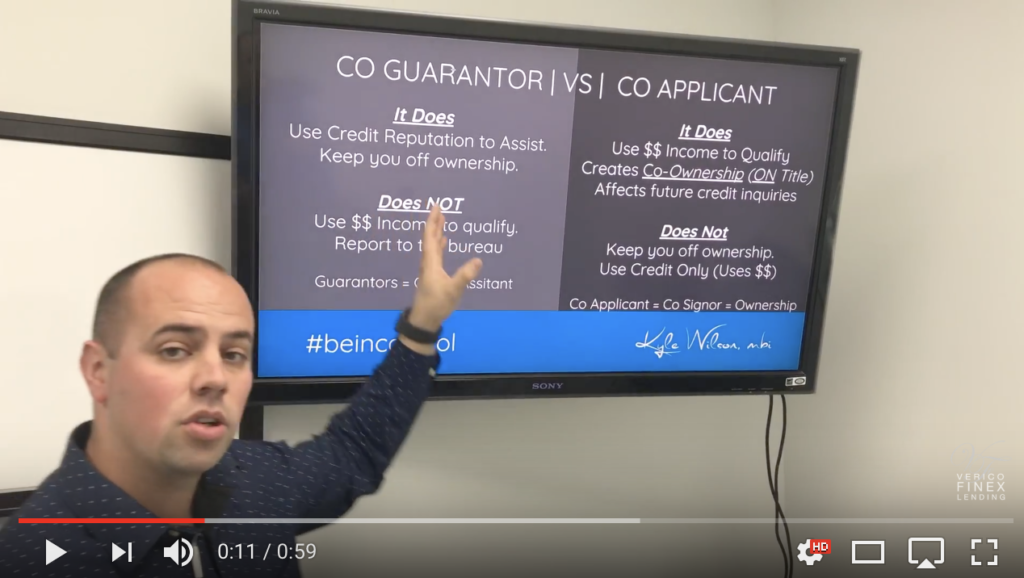

Co Guarantor VS CoSignor

You apply for a Mortgage or Car loan and the bank says “sorry you need a CoSignor”. Without explaining WHY you need this it can be difficult to know which one is the best scenario to fit your needs.

See if a Co Guarantor Vs Cosignor is the right fit.

A Co Guarantor is when someone assists you with credit. However, a Co Guarantor does not OWN your asset nor do they use there own income to help you qualify. Thus a Co Guarantor is simply to assist in helping you if you have no credit or what is called “thin credit”. Most Guarantor strategies are a fit for newer corporations that have not obtained a credit history, so they use one of their directors on the board (CEO, CFO, COO etc) to guarantee the loan with their credit established.

A Co Applicant, also known as a CoSignor. Is much different. A CoSignor will use credit AND income to qualify. Plus they will also be entitled to ownership for the asset (be on title of property or vehicle).

A CoSignor is more common in a mortgage or vehicle purchase because likely you will need not just credit to qualify, but also extra income to get the debt service ratios in line!

Still Confused? A Co Guarantor Vs Cosignor each has their own pros and cons and are a right fit depending on the strategy.

Contact your Mortgage Broker today and explain the scenario you are trying to achieve. A good mortgage broker will make sure the short term and long term strategy is drawn out for you achieve 100% home ownership with NO Co Guarantor or Co Signor once possible.

kylewilson.ca bookpro.co hmcf.ca

#beincontrol #guarantor #cosignor #mortgage #mortgagebroker #homeownership #carloan #loans #mortgagemonday #asset #finance #money

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]