[fusion_builder_container hundred_percent=”no” hundred_percent_height=”no” hundred_percent_height_scroll=”no” hundred_percent_height_center_content=”yes” equal_height_columns=”no” menu_anchor=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”center center” background_repeat=”no-repeat” fade=”no” background_parallax=”none” enable_mobile=”no” parallax_speed=”0.3″ video_mp4=”” video_webm=”” video_ogv=”” video_url=”” video_aspect_ratio=”16:9″ video_loop=”yes” video_mute=”yes” video_preview_image=”” border_size=”” border_color=”” border_style=”solid” margin_top=”” margin_bottom=”” padding_top=”” padding_right=”” padding_bottom=”” padding_left=””][fusion_builder_row][fusion_builder_column type=”1_1″ layout=”1_1″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_separator style_type=”none” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” sep_color=”” top_margin=”20px” bottom_margin=”20px” border_size=”” icon=”” icon_circle=”” icon_circle_color=”” width=”” alignment=”center” /][fusion_title margin_top=”” margin_bottom=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” size=”2″ content_align=”center” style_type=”default” sep_color=””]

0 Financing | Is it worth it? | Zero Percent Loans

[/fusion_title][/fusion_builder_column][fusion_builder_column type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_youtube id=”82f4XXcqyUw” alignment=”center” width=”” height=”” autoplay=”false” api_params=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” /][fusion_imageframe image_id=”2750″ style_type=”none” stylecolor=”” hover_type=”none” bordersize=”” bordercolor=”” borderradius=”” align=”center” lightbox=”no” gallery_id=”” lightbox_image=”” alt=”0 Financing | Zero Percent Loan” link=”https://kylewilson.ca/0-financing/” linktarget=”_self” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=””]https://kylewilson.ca/wp-content/uploads/2018/04/0-financing-zero-percent-loan-1024×576.png[/fusion_imageframe][/fusion_builder_column][fusion_builder_column type=”1_2″ layout=”1_2″ spacing=”” center_content=”no” link=”” target=”_self” min_height=”” hide_on_mobile=”small-visibility,medium-visibility,large-visibility” class=”” id=”” background_color=”” background_image=”” background_position=”left top” background_repeat=”no-repeat” hover_type=”none” border_size=”0″ border_color=”” border_style=”solid” border_position=”all” padding_top=”” padding_right=”” padding_bottom=”” padding_left=”” dimension_margin=”” animation_type=”” animation_direction=”left” animation_speed=”0.3″ animation_offset=”” last=”no”][fusion_text]

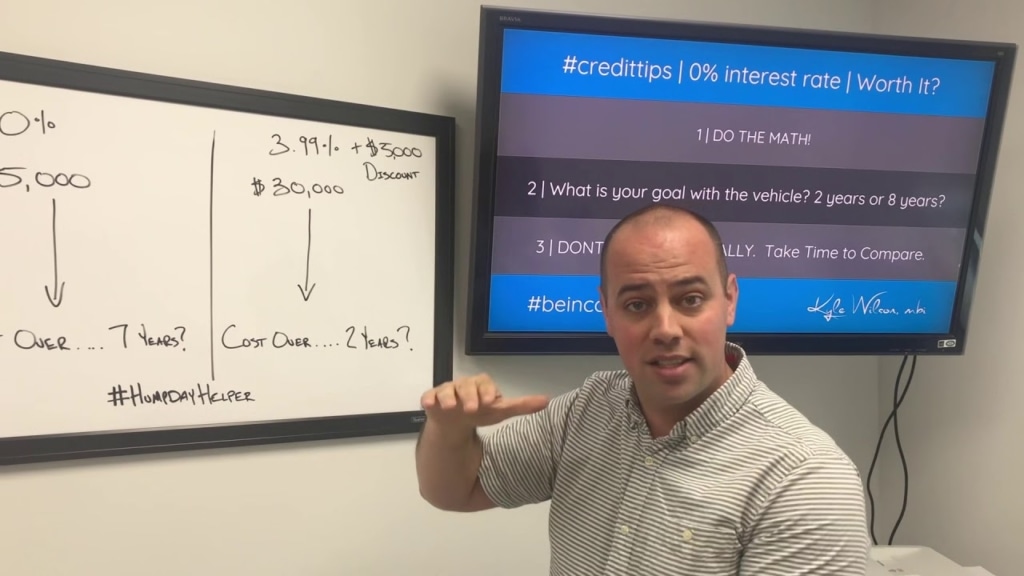

0 Financing | Is it worth it? | Zero Percent Loans

A 0 Financing loan can be a great way to #finance your next #vehicle. But you need to make sure you are getting the best deal at the dealership and #EDUCATE yourself on how to not get wrapped up in just the 0 Financing or Zero Percent Loan offering.

Sometimes a #cardealership will offer a further incentive as a cash discount off the vehicle isf you pay #cash OR finance at a higher #rate. So when should you take the 0 percent financing loan option?

- DO THE MATH! After you finish paying for the vehicle including the interest rate spread over the term of the loan: Is it Cheaper or More money to take the 0 financing loan? This depends how much discount the dealership provides off of the car if you do not take the 0 financing loan.

- How long do you plan to keep the vehicle? 2 years?: Likely you should take the cash discount! If you don’t plan to leverage the 0 financing loan for the long term it may not be worth it. AND DON’T #FOOL YOURSELF, the average person keeps a vehicle for 3.6 years… So don’t get caught up in feeling confident you will “keep this car until you die”.

- Don’t Buy #Emotionally ! A reputable car dealership will provide you full disclosure of the vehicle price PLUS finance and lease options. DO NOT get caught up in the monthly payment… just because it is 0 financing loan and $290 a month for the next 120 months (ya…. that’s 10 years) does not mean it’s a #gooddeal. Dealerships like @kelownamercedesbenz and @sentesautogroup have a #transparent sales process that educates you on your options.

- Finally, if you hate numbers: Seek #advice from a finance professional. A #mortgagebroker is a good source to rely on to crunch the numbers in the #interestrategame .

kylewilson.cabookpro.cohmcf.ca #mercedesbenzkelowna #kelownamercedes #sentesautogroup #zeropercentloan #0financing

[/fusion_text][/fusion_builder_column][/fusion_builder_row][/fusion_builder_container]